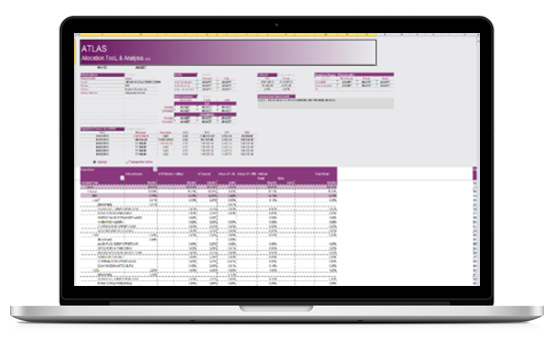

Portfolio monitoring

Balanced & Multi-management Funds

Large French Asset Manager, € 20 billion assets under management

Team of 10 asset managers, 80 portfolios, 15 asset classes - 5 heterogeneous data sources

- Aggregation of heterogeneous information

- Multi-axis & multi-asset portfolio analysis

- Transparisation on 3-levels with custom proxies

- Valuation, exposure and risk calculations

- Cash-flows forecasting

- Raw and transparized inventory with drill-down

- Separate front-ends dedicated to the asset managers and to the leadership

- On premise Osmoze server and Osmoze Excel Add-In on the client side

- Deployment of the Monitoring and Decision-making modules

- Custom module of exposure calculations

- Live in 8 months

Benefits

Trust

in the quality of input data

Precision

of calculations, transparency and traceability of the results

Speed

Response times divided by 100

Strong scalability

that allows to increase the model's precision